News/Blog - 2013

Click on Title of interest below for full article.

Demystifying Mezzanine Financing

Many of our clients ask us about financing alternatives when a commercial bank denies their company's financing request to buy out a partner, finance an acquisition, or allow shareholders to take some money "off the table" in

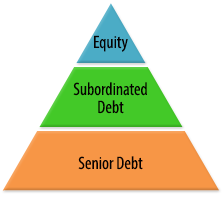

| order to diversify personal assets. We frequently recommend a little-known and even less well-understood financing mechanism for such situations—what investment bankers call mezzanine financing or subordinated debt (sub-debt). A large number of funds provide sub-debt. These funds are structured like private equity funds, except they provide the sub-debt with little or no equity dilution as compared to a PE fund, which usually seeks controlling interest in the company it invests in. Sub-debt is an interesting hybrid of debt and equity. Sub-debt funds lend money to companies on an unsecured, interest-only basis for a term of up to 7 years. They take an equity investor's long-term view of their investments, rather than a commercial bank's short-term view, which often comes with onerous covenants. |

|

|

Below is a summary of what a typical subordinated loan looks like:

- » Criteria

- • Historic and sustainable cash-flow margin of at least 10%

- • Target EBITDA of at least $5 million

- • Minimal customer concentration

- » Rates and terms

- • Current Coupon of 10% to 12%; interest only

- • PIK (Pay in Kind/accrued interest) of 2% due at maturity

- • Origination fee of 2%

- • Minimal equity dilution (depending on the perceived risk of the

- loan; ownership in the form of warrants can often be for less

than 5% of the company) - • Term of 5 to 7 years

- • Prepayment penalty in years 1 through 3

- • Subordinate to bank senior secured lines of credit

- » Amount of Sub-debt provided

- • Total debt (Senior and Sub) between 3x to 4x EBITDA

Some of the benefits to the business owner are:

- » Access to long-term capital, with significantly less impact on company

cash flow than a bank's typical 5-year fully amortized term loan.

- • Bank-term loan vs. sub-debt:

- ♦ A $5,000,000 bank term loan at an interest rate of 4.25% fully

amortized over 5 years = annual payments of $1,111,773 - ♦ A $5,000,000 subordinated loan with interest only at 10% =

annual payments of $500,000.

- » Even with some equity dilution, an owner can maintain operating and

financial control of his company.

- » If the assets of the company (inventory and receivables) grow

sufficiently, the sub-debt loan can be repaid with a less-expensive bank

line of credit at maturity, rather than having to sell the company to

payout equity investors.

Sub-debt is an alternative that is worth exploring when the financing need is beyond the amount of credit that a commercial bank is willing to consider.However, sub-debt is not necessarily appropriate in all financing situations or for all companies.

At Barnard/Montague, we understand the issues facing middle-market business owners and we know the private-capital markets: the investors and lenders to private, middle-market companies. We take the time to understand what the business owners' personal and professional objectives are and analyze the company financials in order to provide the owner with the various financing alternatives potentially available to him or her, the pros and cons of those alternatives, and what needs to be done in the operations of the company in order to maximize value at the time a transaction is undertaken. We would welcome the opportunity to assist in analyzing financing alternatives, find the right investor or lender, and structure and facilitate transactions that will help middle-market companies survive and thrive in these challenging times.

- » Access to long-term capital, with significantly less impact on company

![]()

Barnard/Montague Capital Advisors is a San Francisco–based investment bank providing sell-side and private-placement advisory services to private, middle-market companies throughout the western United States. The firm's primary focus is on companies in a diverse range of industries with revenues between $25 million and $250 million and EBITDA of at least $5 million.

June 26, 2013

Barnard/Montague Advises Riverlake Partners in the Sale of its Portfolio Company

The principals of Barnard/Montague Capital Advisors are pleased to announce the sale of Pinnacle Exhibits, Inc., a portfolio company of Riverlake Partners of Portland, OR, to a group of investors including StoneCreek Capital, Banyan Mezzanine Funds, Jefferson Capital Partners and Diamond State Ventures.

|

Pinnacle Exhibits headquartered in Hillsboro, OR, is an industry-leading, full service provider of custom tradeshow exhibits and experiential events for large corporate customers with national and global brands. Pinnacle Exhibits consistently creates environments and programs that deliver memorable branded experiences, whether through a single exhibit or a multi-tiered marketing communications program. Riverlake Partners, an established Northwest-based private equity firm, engaged Barnard/Montague Capital Advisors as its exclusive advisor to sell Pinnacle Exhibits. Barnard/Montague conducted a competitive auction process to identify the ideal new capital partner in terms of both investment criteria and growth orientation. The firm then |

worked closely with the management team to close the transaction with minimal disruption to the ongoing business of the Company.

![]()

Barnard/Montague Capital Advisors is a San Francisco based investment bank providing sell-side and private placement advisory services to private, middle-market companies throughout the western United States. The firm’s primary focus is on companies with revenues between $25 million and $250 million in a diverse range of industries. The principals of the firm have successfully completed a number of sell side assignments in the business services sector, working with both private equity and strategic buyers.

January 31, 2013

NOW THAT 2013 IS HERE, WHAT NEXT?

Questions middle-market business owners are asking themselves.

|

||

Many business owners struggle to fully understand the many options available to them to achieve liquidity or fuel growth, including the possibility of selling only a portion of their business while maintaining control and then having the opportunity to take “a second bite” at a subsequent sale. We will: |

||

|

||

| Increasing Merger and Acquisition Activity The fundamentals for increased investment, merger and acquisition activity in 2013 are encouraging, providing many opportunities for business owners as they address the above questions: |

||

|

||

Benefits of engaging an investment banker While it seems the current environment would be very conducive to easily completing transactions, because of the continuing uncertainties related to the global economy, government fiscal challenges, and Europe’s debt troubles, investors, acquirers and lenders are wary of inheriting unexpected liabilities. Engaging an investment banker, who will address the issues investors and lenders need to have addressed and provide the business owner with the knowledge of the transaction process, will significantly increase the prospect of closing a transaction and achieving the best value and terms. |