News/Blog - 2011

Click on Title of interest below for full article.

Barnard/Montague Advises in the Sale of the Assets of Microwave Technology Company

The principals of Barnard/Montague Capital Advisors are pleased to announce the sale of Commercial Microwave Technology, Inc., ("CMT") headquartered in Rancho Cordova, CA, to API Technologies Corp. ("API") (NASDAQ:ATNY).

|

CMT is a leading manufacturer of RF and microwave filters for the tele- communication and aerospace industries worldwide. Founded in 1997, CMT had developed an excellent reputation among many Fortune 100 companies as being a sole source supplier of custom filters for use in a variety of applications, including satellites, surveillance, remote metering and interference mitigation. With the majority shareholder looking to retire but wanting to provide a platform for continued growth of the Company, he engaged Barnard/Montague to exclusively represent the Company in a sale process. Barnard/Montague approached a carefully selected |

API designs, develops and manufactures systems, subsystems, RF and secure communications solutions for technically demanding defense, aerospace and commercial applications. The company's international customers include leading Fortune 500 firms, as well as the governments of the U.S., Canada, the United Kingdom, NATO and the European Union.

Barnard/Montague Capital Advisors is a San Francisco based investment bank providing sell-side and private placement advisory services to private, middle-market companies throughout the western United States. The firm’s primary focus is on companies with revenues between $25 million and $250 million in a diverse range of industries. The principals of the firm have successfully completed a number of sell side assignments in the professional staffing industry.

September 6, 2011

Barnard/Montague Provides Strategic and Financial Advisory for Dura Chemicals, Inc.

The principals of Barnard/Montague Capital Advisors are pleased to announce the successful completion of a strategic and financial advisory engagement for Dura Chemicals, Inc, of Emeryville, CA.

|

Dura Chemicals, Inc. is a leading supplier of high-quality metal organics and essential additives worldwide. The Company offers metal organics used as additives and catalysts serving the requirements of Coatings (paint and graphic arts), Polyester, Polyurethane, Lube, Adhesives and Sealant and Petrochemical industries. The Company manufactures and distributes additives which are essential for DURA’s customers to create their final product. Founded in 1994, DURA has grown to become the second largest supplier of drier additives in the U.S. with a worldwide customer network. Dura of |

After considering Barnard/Montague’s review of the Company, analysis of the market and the investor appetite for such an opportunity, the Company has decided to seek equity capital for both recapitalization and growth purposes and has engaged Barnard/

Montague to execute that strategy.

Barnard/Montague Capital Advisors is a San Francisco based investment bank providing sell-side and private placement advisory services to private, middle-market companies throughout the western United States. The firm’s primary focus is on companies with revenues between $25 million and $250 million in a diverse range of industries.

July 30,2011

Wall Street Journal Headlines Economic Gauge – An Update

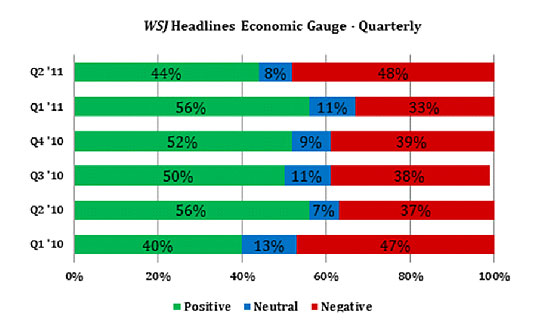

We haven't updated our WSJ Headlines Economic Gauge since January because it was indicating consistently positive results in the economy—that is, until June of this year, when it headed decisively negative.

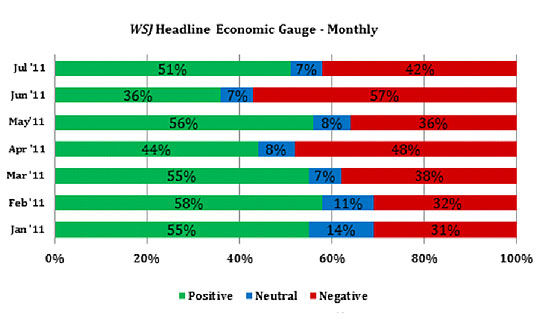

And the monthly results for 2011 show even more dramatically the move into the negative, particularly in June, when the unemployment rate worsened, though there was some improvement in July.

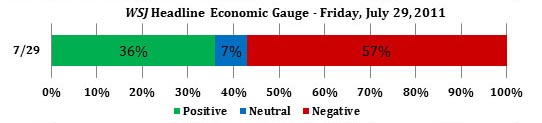

Lastly, while July's headlines in general were more positive than negative, yesterday's WSJ Edition – July 29, once again turned decisively negative as our leaders continue to be at an impasse on the debt ceiling and many other related issues.

The Gauge is a reflection of the increasing uncertainty facing businesses, particularly middle-market companies. We hear it, read it and see it every day in the media: persistent domestic unemployment, continued weakness in residential real estate, increasing cost of commodities, lack of consumer confidence, regulatory burdens making it more difficult and expensive for business to grow, banks maintaining strict credit standards, increasing costs as a result of recent healthcare legislation, weakness in European markets, conflagration in the Middle East, and on and on.

So, what does this mean for middle-market company owners?

Many of our clients have been considering selling their companies, but with business generally being off since mid 2007 they have not been able to achieve the valuation they need in order to retire. In the expectation that the economy would be improving in the near term, many have opted to continue operating their companies in an effort to grow them to the point that they could sell them for an acceptable valuation. However, they are finding the continuing uncertainty in the economy is making growing their bottom line more challenging than they had anticipated.

We would like to offer an alternative for company owners who find themselves in such a situation.

A Strategy for Owners of Middle-Market Companies:

Get partial liquidity now and take a second bite out of the apple later.

A number of our middle-market company owners have recently asked us to assist them in evaluating strategic alternatives. These shareholders have determined that they are not yet ready to sell their companies for two primary reasons:

• They are still passionate about what they do and are not yet readyto exit their business totally and retire.

• Their business valuation has not yet achieved the level they need in

order to sell 100% of the company.

Yes, they understand:

• Investments must be made to grow their companies in order to achievethe valuation they will need to meet their long-term personal financial goals.

• As they get older and are contemplating retirement, they are more averse

to risk—meaning that they would like to get off personal guarantees to their

banks and are no longer comfortable making significant long-term-payback

investments in their companies.

• It is an increasingly difficult business environment with many challenges

that are beyond their control, such that running the business the way they have

in the past may not generate strong enough bottom-line results.

In response to such requests, we are recommending that companies consider what investment bankers call a "recapitalization" strategy. This is an investment mechanism whereby a subordinated debt fund lends to the company or a private equity fund invests capital in it acquiring a majority or minority stake in the company. In either situation, the current shareholders maintain operating control and the current management team continues to run the business. This strategy enables the shareholders to take some money out of the company today thus diversifying their personal assets. At the same time, the new financial partner can provide additional resources to help weather the continuing challenging economic environment as well as to take advantage of opportunities for growth. With a recapitalization strategy, the owners and the investors have the same objectives: improve the company's operations to increase its potential for growth and maximize its value, so that current shareholders may take a second bite out of the apple in 3 to 5 years.

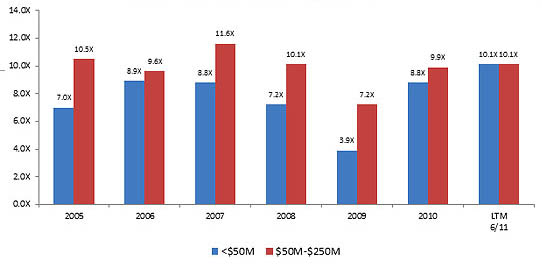

Our experience in the private capital markets and our work with numerous privately held companies have shown that plenty of institutional capital is available for the acquisition of exceptional middle-market companies. Presently, private equity and subordinated debt funds have in excess of $500 billion of committed capital that they need to invest, while domestic non-financial corporations have an amount approaching $2 trillion of cash on their balance sheets, with acquisitions being an important component of their growth strategy. However, there are fewer companies that meet their investment criteria or for which the valuations are at levels acceptable to shareholders. Nonetheless, merger and acquisition activity has been steadily recovering from its low point in 2009, though much of it is currently focused on larger companies, with about 30% of the activity taking place between private equity firms ( i.e. private equity firms selling to and buying from other private equity firms). But this increased activity is a good precursor to a rebound in the middle-market arena. As this segment recovers, the dearth of sound middle-market investment opportunities means that investors with pent-up investment needs are increasingly flexible in structuring transactions. This results in an increased number of funds willing to invest in recapitalizations to help companies grow, the primary objective being the sale of the company in 3 to 5 years.

It is important to note that valuations for middle-market companies are improving. Although the chart below is a bit deceiving in that many private transactions are not reported at all so the average multiples paid are actually somewhat lower, the trends are clearly positive.

Several clients have engaged us to represent them in executing this recapitalization strategy, presenting their companies to multiple sources of capital—both private equity and subordinated debt funds. It is our goal to find the right investor with the least dilutive structure on terms that best allow the company and its shareholders to accomplish their objectives. We also feel that the investors we seek for a company must share the same values, vision, and plan as those of our client. With the objective of maximizing value when the company is ultimately ready to be sold, a good financial partner can assist in improving corporate governance, in expanding distribution channels, and in financing acquisitions that the shareholders may not want to undertake on their own.

With our deep knowledge of the private capital markets and the recapitalization process, the partners of Barnard/Montague are ideally suited to assist middle-market company shareholders explore their strategic alternatives to achieve liquidity.

Barnard/Montague Capital Advisors is a San Francisco–based investment bank providing sell-side and private-placement advisory services to privately held, middle-market companies throughout the western United States. The firm's primary focus is on companies with revenues between $20 million and $250 million in a diverse range of industries.

Please contact us if we can be of assistance:

Bailey S. “Biff” Barnard, Sr.

925-386-6171

bbarnard@barnardmontague.com

Jeanne Montague

415-928-2183

jmontague@barnardmontague.com

David B. Sloan

415-992-5463

dsloan@barnardmontague.com

www.BarnardMontague.com

Press Release

May 1, 2011

San Francisco, CA

Philip F. Otto Joins Barnard/Montague’s Board of Advisors

Biff Barnard, Jeanne Montague, and David Sloan, the partners of Barnard/Montague Capital Advisors, today announced that Philip F. Otto has joined the firm’s Board of Advisors.

Mr. Otto will be a tremendous resource to the firm, having held senior executive positions including chairman of the board, chief executive officer, and chief financial officer in high technology companies serving diverse markets worldwide. He has also provided financial, strategic, M&A and board services to a broad array of technology and growth-oriented investors and companies ranging from a publicly-traded wireless communications service provider to a publicly-held gaming equipment manufacturer.

An independent investor and consultant living in Sonoma, California, Mr. Otto currently serves on the boards of Opnext, Inc., a public company in the fiber optics equipment business, and Charisela, Inc., an early-stage company manufacturing specialty chemical reagents for drug research and clinical laboratories. Previously, Mr. Otto was CEO of Schilling Robotics, Inc., a privately held manufacturer of subsea control systems, remotely operated vehicles, and other high technology equipment for offshore oil exploration and production. Mr. Otto was CEO and a Director of Optical Communication Products, Inc., a fiber optic component supplier, until its acquisition by Oplink Communications, Inc. He also served as Chairman and CEO of MedioStream, Inc., a multi-media software company headquartered in Silicon Valley and Shanghai. Prior to that, he served as Chairman and CEO of California Microwave, Inc., a publicly-traded supplier of microwave and satellite communications equipment. He holds a BS in engineering from Yale University and an MBA from Harvard Business School.

Mr. Otto will take an active role in sourcing and assisting in the processing of transactions in conjunction with the Barnard/Montague partners as well as providing advice to the firm, its clients and referral sources.

Barnard/Montague Capital Advisors is a San Francisco–based investment bank providing sell-side and private-placement advisory services to privately held, middle-market companies throughout the western United States. The firm’s primary focus is on companies with revenues between $20 million and $250 million in a diverse range of industries.

Bailey S. “Biff” Barnard, Sr.

925-386-6171

bbarnard@barnardmontague.com

Jeanne Montague

415-928-2183

jmontague@barnardmontague.com

David B. Sloan

415-992-25463

dsloan@barnardmontague.com

www.BarnardMontague.com

Press Release

April 4, 2011

San Francisco, CA

David B. Sloan Joins Barnard/Montague Capital Advisors

Biff Barnard and Jeanne Montague, the founders of Barnard/Montague Capital Advisors, today announced that David B. Sloan has joined the firm as a partner.

Mr. Sloan has over 20 years experience providing mergers, acquisitions, capital raising, and restructuring advisory services to corporate clients worldwide. He has completed transactions with clients ranging from well recognized global corporations to privately held, early stage ventures. He has experience with companies in agribusiness, specialty chemicals, financial services, and consumer products, among others. In 2006, Mr. Sloan established Bancroft Partners, an investment banking firm serving West Coast–based entrepreneurs and early- to mid-stage companies with their venture formations, capital raising, and M&A needs. From 2004 to 2005, Mr. Sloan served as an executive director for Rabobank, with West Coast agribusiness M&A being his focus. Prior to 2004, Mr. Sloan spent 15 years with JP Morgan Chase, where he spent the first eight years based in New York focusing on domestic M&A, and the subsequent seven years based in Hong Kong building a premier M&A franchise in Asia. Mr. Sloan received a B.A. from Brown University.

“David’s work in agribusiness, specialty chemicals, and financial services adds to the experience Biff and I have working with privately held, middle-market companies in food and beverage, consumer products, business services, manufacturing, and distribution,” said Montague. “We are very happy to have David joining Barnard/Montague, as he has excellent investment banking experience and a depth of knowledge in a variety of industries and geographies,” added Barnard.

“I am excited to be joining Jeanne and Biff as a partner at Barnard/Montague,” stated Sloan. “We share the common vision of a high-quality investment banking advisory firm. Together I believe we can provide a greater value to our clients by leveraging our combined extensive transaction experience, industry insights, and strategic reach.”

Barnard/Montague Capital Advisors is a San Francisco–based investment bank providing sell-side and private-placement advisory services to privately held, middle-market companies throughout the western United States. The firm’s primary focus is on companies with revenues between $20 million and $250 million in a diverse range of industries.

David Sloan can be reached at:

415-992-5463415-595-6939 (cell)

dsloan@barnardmontague.com

www.BarnardMontague.com

January 2, 2011

Wall Street Journal Headlines Economic Gauge Indicates Solid Improvement

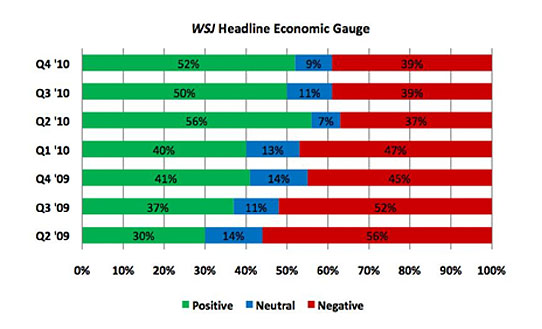

Since our last update, the WSJ Headlines Economic Gauge has continued to move in a positive direction, with very strong quarterly results and even stronger week-to-week trends during the month of December.

(Followers of our blog will recall that we created our WSJ Headline Economic Gauge under the premise that the count of the Wall Street Journal finance-related article headlines with a positive, neutral, or negative tone can provide an indication of the economy's status. We began tracking the headlines of the Friday West Coast edition of the WSJ in April '09.)

The third and fourth quarters of 2010 were solidly positive, with a slight uptick in Q4; although, interestingly enough, not back to the levels posted in Q2. However, Q2 may have been superficially positive with all of the government subsidies and incentives available during that period of time.

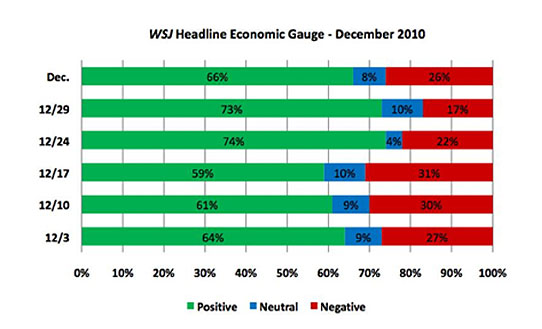

The week-to-week results in December were even more encouraging, culminating with the December 29th edition showing 73% Positive, 17% Negative, and 10% Neutral. The average for the month showed 66% Positive, 26% Negative, and 8% Neutral-the most positive month since we began the Gauge!

With much more consistent optimism than any period in the past two years, a sampling of some recent WSJ articles highlights the sense that the economy is finally truly improving:

From WSJ 1/6:

Last Month, Bolstering Hopes on Economic Growth."

From WSJ 1/5:

• "U.S. Car Business in Major Shift-U.S. auto sales rose 11% in December,capping a year that suggests the industry is on the verge of one of the

most dramatic shifts in its history."

From WSJ 1/4:

• "U.S. Factory Activity Climbed in December...providing a burst ofmomentum to the economy as it entered a new year."

From WSJ 1/3:

• "Big Firms Poised To Spend Again-Big U.S. companies have cleaned uptheir balance sheets and, flush with cash, appear open to using it in 2011

on factories, stores, and even hiring....Profits are higher, too, after

companies slashed their work forces and closed less-efficient operations.

Total U.S. corporate profits in 2010's third quarter rose 26% from a year

earlier...the highest in four years..."

From WSJ 12/30:

• "Banks Open Loan Spigot-Uptick in Lending to Businesses Is Expectedto Accelerate Next Year."

• "Stronger Economy Helps State Tax Revenues Climb."

From WSJ 12/29:

• "News in recent weeks...has offered hope the economy is on the cusp ofstrong, sustainable growth."

• "Retail sales returned to levels seen just before the recession started

in 2007."

• "Manufacturing continues to expand."

• "U.S. exports are back to where they were just before the financial crisis." • "Optimism among heads of small businesses and larger corporations

is near pre-recession levels."

• "Small Cap Meant Big Rise This Year-It has been a good year for the

stock market. It has been a great year for small caps."

Considering the many strong economic reports, these kinds of articles, and the most positive results we have seen since we began the WSJ Headlines Economic Gauge, the only conclusions one can come to is that we are through the worst of the economic problems and 2011 should show slow but solid growth.

Many of the middle-market business owners we have been talking with about either raising capital for growth, selling their companies, or at least getting some liquidity out of their companies, have been hesitant to consider a transaction with all the uncertainty in the economy for the past several years. Now, with a clear sense that the economy has turned the corner and is showing definite improvement, we think this is the time for business owners to begin discussing the alternatives that may be available to them to finance growth or recaps, or to look at a sale.

With a combined more than 55 years of experience providing investment banking advisory services to privately held, middle-market companies in a broad range of industries, we are well prepared in help in exploring those alternatives.

Bailey S. “Biff” Barnard, Sr.

925-386-6171

bbarnard@barnardmontague.com

Jeanne Montague

415-928-2183

jmontague@barnardmontague.com

www.BarnardMontague.com