News/Blog - 2010

Click on Title of interest below for full article.

The Changing World of Middle–Market M&A: Are the Bleakest Days Behind Us?

Recently, I served as the moderator of a panel of middle-market focused investment bankers sponsored by the Association for Corporate Growth - San Francisco Chapter. The audience was comprised of business owners as

well as private equity professionals, bankers, lawyers, accountants and other advisers to middle-market companies. The subject was “The Changing World of Middle-Market M&A: Are the Bleakest Days Behind Us?” and the answer was resoundingly, “YES!”.

Each panelist has a different approach to the market – one primarily does sell-side assignments for private equity firms, one does sell-side for both private equity firms and companies in the $250MM+ revenue range, one does buy-side for both private equity firms and larger corporations, one focuses on ESOPs, and Barnard/Montague primarily does sell-side assignments for privately held, middle-market companies with revenues up to $250MM. As a result of this broad combination of approaches to the M&A business, we discussed what is really happening in the M&A market today: the quality and quantity of deal flow, the availability of debt for transactions, what valuations levels are, what deals are getting done, etc.

While the panel agreed there is still a great degree of uncertainty in the domestic and world economies with many problems facing us:

• Increasing materials costs reducing gross margins

• Economic growth of 2% for Q3 is too slow to have meaningful impact

on unemployment

• Government at all levels is near broke and cutting jobs

• Continuing unemployment causing consumers to be very cautious…

… the mood of the panel was clearly upbeat as a result of increasingly positive signs:

• Pent up demand on the buy- and sell-side; investors have lots of cashto invest

• Increased M&A activity for larger transactions

• Valuation multiples increasing/debt available for acquisitions of well

run companies

• Political changes potentially positive for business

• US manufacturing picking up as a result of rising exports

Some of the panel’s specific observations were:

1. Purchase multiples are increasing, particularly for larger transactions,BUT will probably not reach the high levels of 2007.

2. Private equity firms are willing to invest up to 50% of equity for

attractive investments.

3. Private equity and subordinated debt providers are willing to make

minority investments in good quality companies, allowing shareholders

“to take some money off the table” while continuing to run the business.

4. Domestic and foreign companies, as well as private equity firms, are

acquisitive with lots of capital to invest, seeing growth by acquisition

as an important strategy.

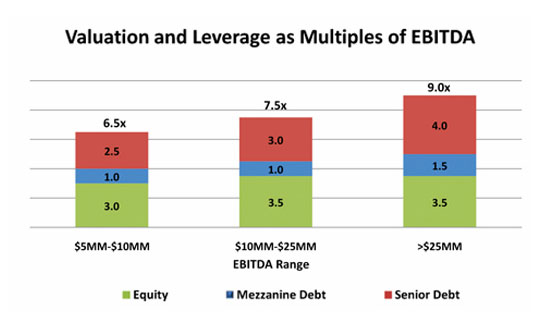

The chart below summarizes current valuation multiples broken down by EBITDA ranges of the target company and shows the equity, mezzanine and senior debt components at the various ranges:

Finally, the panel concluded that M&A activity is recovering for middle-market companies and the bleakest days are, in fact, behind us. One note of caution was that, although the M&A environment is improving, both private equity and strategic investors are still cautious and it takes longer than it has in the past to get to a closed transaction. Therefore, for middle-market company owners who are, or maybe should be, considering selling part or all of their company, this is a good time to begin exploring alternatives.

We send our best wishes for a very happy holiday season and a new year that brings a stronger economy and more opportunity for business growth.

Please contact me or my partner, Jeanne Montague,

if we can be of assistance:

Bailey S. “Biff” Barnard, Sr.

925-386-6171

bbarnard@barnardmontague.com

Jeanne Montague

415-928-2183

jmontague@barnardmontague.com

www.BarnardMontague.com

October 22, 2010

Barnard/Montague Advises in Sale of Consulting and IT Staffing Services Company

The principals of Barnard/Montague Capital Advisors are pleased to announce the sale of Partners in Business Systems, Inc., of Danville, CA, to Software Management Consultants, Inc., with corporate headquarters in Glendale, CA.

|

Partners in Business Systems, Inc., is a premier provider of professional consulting and IT staffing services to a select group of clients in Northern California. The company is well known for its team of extremely well qualified consultants who bring their significant years of experience to client engagements.

For over 25 years, Software Management Consultants, Inc., (SMCI) has been a well-recognized IT staffing solutions leader in the various regional markets that it serves. With 9 branch offices in California, Arizona, Texas, North Carolina and Florida, SMCI’s emphasis is on the establishment of long-term relation- |

Barnard/Montague is a San Francisco based investment bank providing sell-side and private placement advisory services to private, middle-market companies throughout the western United States. The firm’s primary focus is on companies with revenues between $25 million and $250 million in a diverse range of industries. The principals of the firm have successfully completed a number of sell side assignments in the professional staffing industry.

Jeanne Montague

415-928-2183

jmontague@barnardmontague.com

Bailey S. “Biff” Barnard, Sr.

925-386-6171

bbarnard@barnardmontague.com

www.BarnardMontague.com

July 21, 2010

Middle-Market M&A Activity Shows Signs of Improvement

Review of the First Half of 2010

Many observers are commenting that M&A activity is slowing and that the trends are indicating a weak second half. However, as it pertains to middle-market companies, the statistics are somewhat misleading. It is true that announced global M&A activity remained stable during H1 2010 at $976 billion (H1 2009 was at $977 billion), and that announced U.S. H1 2010 M&A activity, at $339 billion, was down 5% from H1 2009 (at $358 billion)—according to Thomson Reuters. However, M&A volumes for H1 2010 for deals of less than $500 million were up 39% over H1 2009. Another interesting change is that M&A activity backed by global private-equity funds for Q2 2010 totaled $40 billion, which is an increase of 33% over Q1 2010 and an increase of 125% from Q1 2009, with year-to-date activity up 102% from H1 2009. These are all clear signs that domestic middle-market activity is accelerating!

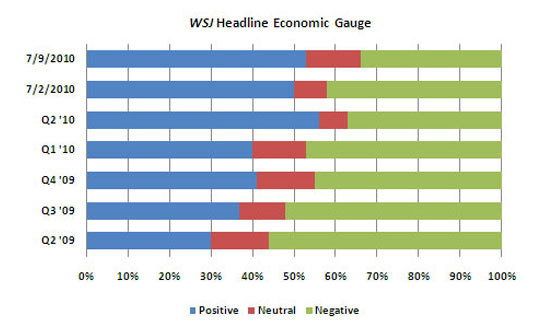

Since our WSJ Headline Economic Gauge turned positive in the beginning of Q2 2010, it continues to show marginally positive results with 50% and 53% positive for the first and second weeks of July, respectively. We think “marginally” is the telling word here when describing these positive signs, with uncertainty and caution still prevailing among investors, buyers, sellers, and lenders.

Looking Ahead

With the information above looking at M&A activity in the recent past, let’s take a look at the future. In early July, IntraLinks and mergermarket released the results of a survey of global M&A practitioners taken in April and May of 2010—the results of which are resoundingly positive. 89% of North American respondents expect the level of deal activity to increase over the next year, and 80% of the respondents expect the bulk of the North American M&A activity to be in deals of $500 million or less over the next 12 months—a big change from the recent past when M&A activity was comprised principally of multi-billion-dollar deals.

Based on the recent increase in activity we have experienced and on reports from other investment bankers and private equity firms, we agree that the volume of M&A transactions for middle-market companies will continue to build for the balance of this year and for the next several years to follow. It is clear that there is pent-up demand on both the buy- and sell-side:

On the Buy-Side:

• Private equity firms have in excess of $500 billion of committed capital

they must invest before the investment periods for those funds lapse.

They are paying premiums for well-run companies and are increasingly

flexible in structuring transactions, often willing to provide capital for

recapitalizations, as well as to make both minority and majority investments.

• Domestic corporations have almost $2 trillion of cash on their balance

sheets. Though still cautious, they see acquisitions as an important

component of their growth strategy. They are often paying significantly

higher prices than what private equity firms will pay for well-run companies

that fit into their growth strategies.

• Foreign corporations still see investing in U.S. companies as safer than

investing in other areas of the world.

On the Sell-Side:

hold during the recession are now seeking liquidity as business is

improving, debt is increasingly available for transactions, and as buyers

become more active.

• In 2009, private equity firms were internally focused on managing

problems in their portfolios. As investment periods of current funds are

winding down, they need to get liquidity in order to raise new funds, so they

are now anxious to sell portfolio companies.

What Does All of This Mean for Middle-Market Company Owners?

It has been challenging for many middle-market companies over the past several years as management has been forced to deal with the difficult economy. Buyers recognize that many of the companies that have survived and are now beginning to grow again present significant upside opportunity. Both financial and strategic buyers have waited for the economy to show signs of improvement, and have therefore let business owners bear the downside risks until the risk of revenue decline is behind them. It is now time for those company owners, who have managed through difficult times, to capitalize on what they have accomplished.

In this changing and volatile environment both buyers and sellers are making concessions on valuation, terms, and deal structure. Buyers are willing to pay higher prices to meet sellers’ price expectations, and sellers are willing to be more flexible on terms and deal structure in order to achieve higher valuations.

With the many positive signs of an improving middle-market M&A environment, we believe it is a good time for owners to explore liquidity alternatives and potentially selling part or all of their company. We at Barnard/Montague welcome the opportunity to work with owners and their advisors in exploring the avenues to maximize valuations.

Press Release

June 15, 2010

San Francisco, CA

Barnard/Montague Capital Advisors Establishes Strategic Alliances Internationally

Biff Barnard and Jeanne Montague, the principals of Barnard/Montague Capital Advisors, today announced the establishment of several important strategic alliances with merchant and investment banking firms that give the middle-market focused investment bank broad international reach.

As both financial and strategic investors/buyers in today's markets may be foreign as well as domestic, it is increasingly important that investment banks have access to investors from around the world.

Barnard/Montague now has access to international markets through strategic alliances with Chart Group Advisors, a FINRA member firm and subsidiary of The Chart Group, a New York City–based merchant banking firm with extensive contacts in Europe, the Middle East and Asia; with G.R. Associates, a Tokyo-based investment banking firm; and with Capital Express, a Mumbai, India-based investment banking firm.

“We are pleased to have established this important relationship with Barnard/Montague,” stated Jim Whitcomb, a Chart Group Managing Director. “We have known Biff Barnard for many years and feel his joining together with Jeanne Montague creates a compelling team of professionals, who are very well respected for providing quality investment banking services to middle-market companies throughout the western U.S.”

Yoshitake Fujikawa, President of G.R. Associates added, “Japanese financial and strategic investors are very interested in finding opportunities to invest in American middle-market companies. Because of their reputation for professionalism and integrity and the depth of their relationships with such companies in the western U.S., our strategic alliance with Barnard/Montague will provide our clients with quality investment opportunities.”

Suresh Balasubramaniam of Capital Express commented, “I was introduced to Biff Barnard by several very good friends who run companies in California and for whom Biff had provided investment banking advisory services. They reported that Biff and his partner, Jeanne Montague, are respected throughout the western U.S. middle-market investment community for providing thoughtful advice and for being extremely well connected. As I was looking to establish a presence in the U.S. with a respected middle-market focused investment banking firm, I reached out to Biff and Jeanne and I could not be happier to have formalized this strategic alliance with Barnard/Montague.”

“The strategic alliances we have established with The Chart Group, G.R. Associates and Capital Express enable Barnard/Montague to provide our clients with access to investors almost literarily all over the globe,” stated Biff Barnard. “This access, in addition to our deep relationships with many domestic companies and private equity firms, gives our clients the exposure required to maximize company valuations."

About the Firms:

The Chart Group

The Chart Group was organized in 1994. The firm’s professionals share ownership of the company with a large global network of partners who provide access, expertise, and capital. The Chart Group Partners are composed of family investment offices, professional firms, and industrial companies in 16 countries.

Chart Group Advisors provides discreet, senior-level advice and capital access to corporate clients around the world. The company has significant cross-border transaction experience initiated through its overseas offices, its partner network, and strategic affiliations with investment banks in Europe, Asia, and the Middle East .

For more information on the Chart Group and Chart Group Advisors, please visit www.chartgroup.com.

G.R. Associates

G.R. Associates’ president Yoshitake Fujikawa founded the company in 1995. The firm provides Western middle-market companies with access to Japanese strategic and financial investors/acquirers and provides Japanese strategic and financial investors with access to investment opportunities in the West. G.R. Associates also offers financial advisory services to Western companies looking to expand into or gain access to customers or suppliers in Japan. The company is also well connected to senior-level Japanese banking, industry, and government executives.

For more information on G.R Associates, please visit www.gra.co.jp.

Capital Express

Suresh Balasubramaniam founded Capital Express in 2005. The firm provides middle-market companies with advisory services in the areas of mergers and acquisitions, private equity capital raising as well as structured and acquisition finance. Capital Express also has a separate desk for real estate private equity and structured finance. Capital Express is well connected to a large number of middle-market companies, local banks and financial investors throughout India.

For more information on Capital Express, please visit www.capitalexpress.in.

For more information on

Barnard/Montague’s International Alliances

Please click here:

International Alliances

May 3, 2010

Middle-Market Company Performance and M&A Activity Improving

There are increasing indications that middle-market businesses are performing better. As a result, banks and other sources of debt seem to be more willing to lend, middle-market merger and acquisition activity is beginning to pick up, and valuations are improving.

Business owners across a broad number of industries are reporting an uptick in revenue and earnings. Bankers and private equity firms are telling us that many of their portfolio companies that have weathered the economic storm are not just stabilizing but are also showing month-to-month improvement. The Wall Street Journal of April 30 estimated that GDP would rise at a 3.5% annualized rate for Q1 ’10, business spending on equipment and software was growing at an 8% pace and consumer spending was growing at by nearly 4% - twice that of the prior quarter and its third consecutive increase . Though many banks are still at risk, others are lending again. There seems to be an increased domestic and foreign demand for U.S. products and services. All good signs!

…And our WSJ Headline Economic Gauge for March and April ‘10 confirms that the economy is clearly on the mend. Followers of our blog will recall that we created our WSJ Headline Economic Gauge under the premise that the tone of the business headlines in the Wall Street Journal will provide a clear indication of when the economy is turning or has turned around. (Count the number of WSJ business article headlines that are positive, neutral, and negative in each edition; when the balance changes from negative to positive, we will be able to tell the economy is improving.) In March ’09, we began tracking the WSJ headlines in each Friday edition and below we summarize the results quarterly for 2009 and monthly for 2010. March ’10 shows a strong 49% of the articles positive, 38% negative, and 13% neutral; and April shows a whopping 60% positive, 32% negative, and 8% neutral—the best results we have seen since we began the Gauge!

Month |

Positive |

Neutral |

Negative |

Total Headlines |

|---|---|---|---|---|

Mar '09

|

18/26% |

6/9% |

45/65% |

69 |

Q2 '09

|

140/30% |

65/14% |

263/56% |

468 |

Q3 '09

|

156/37% |

46/11% |

216/52% |

418 |

Q4 '09

|

179/41% |

59/14% |

194/45% |

432 |

Jan '10

|

51/34% |

20/13% |

78/52% |

149 |

Feb '10

|

54/41% |

15/11% |

64/48% |

133 |

Mar '10

|

46/49% |

12/13% |

35/38% |

130 |

Apr '10

|

110/60% |

15/8% |

59/32% |

184 |

Due largely to the long-awaited upturn in business activity in addition to pent-up demand on both the buy and sell side and the increased availability of leverage, M&A activity is also picking up, having started with larger transactions and, more recently, increasing in the middle-market. On the sell side, private equity firms need liquidity events in their portfolios. Additionally, business owners—particularly “baby-boomer” business owners—who may be looking to retire but have not been able to get the desired value in selling their companies, are seeking liquidity. With an up-tick in business activity and the prospect of increased capital gains tax rates in 2011, many business owners with whom we have been speaking for some time are now coming to us saying they are ready to consider a sale or at least a recapitalization.

On the buy side, both domestic and foreign corporations see growth by acquisition as a necessity. It is reported that there is in excess of $1 trillion on the balance sheets of domestic corporations and foreign corporations still see investing in U.S. companies as safer than investing in other areas. Furthermore, private equity firms are sitting on committed but un-invested funds reportedly somewhere in the neighborhood of $400 billion. Those firms need to either make investments or risk returning commitments to limited partners.

As reported by Thompson Financial and others, overall middle market disclosed deal activity is rebounding. Both deal volume and number of transactions for deals with enterprise values of $10M to $250M are up for the past four successive quarters. While we do not think that valuations for middle-market transactions will return to the unsustainable levels of mid 2007, we expect valuation multiples to slowly increase as debt becomes more available and business performance improves.

While all of this points to improving M&A activity, lenders and investors remain cautious in the face of continuing high unemployment and underemployment, in addition to being concerned about both the residential and commercial real estate markets and the ongoing financial problems of the federal, state, and local governments. Nonetheless, with the many positive signs of an improving economy, we believe it is a good time for middle-market business owners to explore financing alternatives and the possible sale of part or all of their company.

April 5, 2010

Capital Gains Tax Rate Increase and Its Impact on the Sale of a Business

We are surprised that we are just now beginning to hear discussions of increased taxes and actions individuals should consider taking to address that possibility.

The prospect of the capital gains tax rate increasing from 15% to at least 20% in 2011 is real. There is also talk of personal federal tax rates increasing, particularly for the more affluent. And with mounting deficits and the government’s seeming inability to make meaningful reductions in expenses, California and many other states may have few options but to increase state tax rates—on both ordinary income and capital gains. Consequently, more and more accountants and financial planners are beginning to advise their clients to consider accelerating tax payments, as today’s tax rates may never again be this low. This advice is particularly relevant for business owners who may have delayed considering selling their companies in hopes that the economy will soon improve. (If you have read some of our earlier blogs, we do not think that the economy, as it impacts middle-market companies, particularly in California, will improve meaningfully in the foreseeable future.) Business owners should consider what effect an increase in tax rates will have on the net after-tax proceeds resulting from the sale of their business. Or put differently, they should look at the increased EBITDA (earnings before interest, taxes, depreciation, and amortization) that the business would have to achieve in order to obtain the same after-tax proceeds of a sale completed before pending increases in take rates. Here is an example:

Assume the following:

• The federal capital gains tax rate is increased from 15% to 20%beginning in 2011

• The maximum personal federal tax rate is increased from 35% to 39.6% • The company EBITDA is $10,000,000

• The sales price multiple is 5.50 times , resulting in the sale price and

taxable gain of $55,000,000 (ignoring any basis issues for example

purposes)

As a result, the federal capital gains tax on a $55,000,000 gain would increase from $8,250,000 (15% of $55,000,000) if the sale were completed in 2010 to $11,000,000 (20% of $55,000,000) if the sale were completed in 2011—an increase of $2,750,000.

After the additional charges for personal federal and state taxes, the net proceeds to shareholders would be reduced from $22,833,031 if the sale were completed in 2010 to $19,542,109 if the sale were completed in 2011—a reduction of $3,290,922 or 14.4%! Put differently, to achieve the same net after-tax proceeds if the sale were made in 2011 as opposed to 2010, EBITDA would have to increase by 17%! The message is that business owners who are considering selling their company in the next several years should think about doing so in 2010 rather than wait and potentially realize lower net after-tax proceeds as a result of increased taxes that seem to be inevitable. Additionally, as a thoughtful sale process can take six months or longer, we encourage business owners to act sooner rather than later. We at Barnard/Montague Capital Advisors welcome the opportunity to explore a sale transaction with you or your business owner clients. (If you would like to see the model we developed to analyze the tax impact on a business sale, please notify us and we would be happy to email it to you.

January 18, 2010

WSJ Headline Economic Gauge - Sense of Optimism Balanced with the Realities of the Marketplace

As we enter 2010, there is an increased amount of optimism about our economy and middle-market M&A activity being expressed by many of the people I talk with – business owners, middle-market focused private equity and

the surface. We look forward to continuing to follow the Gauge and reporting through 2010.

Month |

Positive |

Neutral |

Negative |

Total Headlines |

|---|---|---|---|---|

March

|

18/26%

|

6/9% |

45/65% |

69 |

April

|

40/32%

|

13/10% |

71/51% |

124 |

May

|

50/23%

|

37/17% |

131/60% |

218 |

June

|

50/40%

|

15/12% |

61/48% |

126 |

July

|

76/35%

|

26/12% |

113/53% |

215 |

August

|

31/42%

|

11/15% |

31/42% |

73 |

September

|

49/38%

|

9/7% |

72/55% |

130 |

October

|

94/49%

|

16/8% |

81/42% |

191 |

November

|

51/43%

|

17/14% |

51/43% |

119 |

| December | 34/28% |

26/21% |

61/51% |

122 |

The nascent sense of optimism, though, needs to be balanced with some of the realities of the marketplace, namely: underemployment, lack of available debt for many small and middle-market companies, a continuing shaky housing market, and the abysmal shape of most state and municipal finances. In fact, The San Francisco Business Times reported in its January 1-7, 2010, edition that nearly 7 in 10 SF Bay Area business owner respondents to its annual December poll on the economy said that they have seen no sign of recovery; and less than 1 in 10 said they are fully through the downturn.

Underemployment

Recent reports have indicated that the rate of increase in unemployment is slowing with “only” 85,000 jobs lost in December; however, with that number the WSJ (Saturday, January 9-10) reports that in December 2009, there were 7.2million fewer jobs than in December 2007. The WSJ article continued that the unemployment rate remained at 10% BUT only because many workers stopped looking and were not counted; and that underemployment – including those who have quit looking for jobs or are working part time – is hovering at in excess of a staggering 17%. Just to keep up with normal population growth, the economy needs to generate 100,000 new jobs per month. It seems clear that we have a long way to go before the economy moves from reducing the rate of increase in unemployment to true reduction in unemployment. And until that happens, the consumer is going to be hesitant to increase spending resulting in a continued drag on the economy.

Lack of Availability of Debt

For the third quarter of 2009, Federal Reserve data showed that debt outstanding to small and middle-market businesses was off by about 10% - bank debt and all other forms of credit except owners’ net investment. Ask any business owner and he will tell you that most bank debt and particularly inventory financing has been reduced even for companies that are long-standing bank customers, in some cases reduced significantly. It is a fact that the volume of bank loans to small and middle-market companies has been reduced and new loans are increasingly difficult to obtain. For the banks, their over-riding issue is trying to maintain strong balance sheets in the face of rising delinquency rates for commercial mortgages. The WSJ on January 8, 2010, reported that 6% of commercial mortgage borrowers in the U.S. have fallen behind in their payments. The article quoted Jefferies & Co. saying that by year’s end, delinquency rates on loans for hotels, shopping malls and other commercial properties could rise to between 9% and 14%. It is not clear whether banks are facing up to the full extent of losses on the books as the practice of “amend and extend” may be concealing the true level of problem loans. But they do not want to foreclose on those potentially bad loans so they have little choice. And those potential problems for their balance sheets make it almost impossible for them to lend to even moderately qualified borrowers. I don’t see bank lending returning to pre-recession levels for some time to come.

Shaky Housing Market

Year-end data showed some signs that the housing market was stabilizing; however, a continuing flood of foreclosures – some estimate as many as 1.7 million in the next several months - and the eventual end of government support threaten that trend. In fact, many would argue that most of the rebound in existing home sales has been driven by the government’s tax credit for first time home buyers. With government subsidies coming to an end, many are expecting a drop in sales. Additionally, with a large and increasing inventory of foreclosed homes as a result of the unemployed and underemployed struggling to keep up on mortgage payments, it seems that a true and sustainable housing recovery is a long way off.

State and Municipal Finances

The SF Chronicle reported on January 17, that “the sharpest decline in state tax revenue on record is hammering 48 out of 50 states”. The result is that states and municipalities are slashing expenses across the board including lay-offs in all categories – K-12 education, higher education, transportation, public health, public safety and other state and municipal employees – and raising revenues any way they can. These large spending cuts and tax increases are deepening the recession and these budget problems are expected to persist through at least 2012! The Chronicle reported that the Center on Budget and Policy Priorities estimates that the current states’ budget gap is at nearly $100 billion and will grow to $180 billion as revenues continue to fall. We have not yet felt the full extent of these problems and there are no easy solutions.

So, what does all this mean for middle-market companies? With the many continuing pressures on the economy and a true recovery still a ways off, business owners must explore alternatives to traditional bank financing for both working capital and for growth; they must make sure their balance sheets are strong so that they will be able to sustain their business in these challenging times; and they must make sure they are managing their companies as efficiently as possibleby considering new or different ways of operating the business.

It also means that there are opportunities: acquire vulnerable competitors at attractive valuations; take on institutional financial partners who can help to improve balance sheets - commercial finance companies, subordinated debt providers or private equity firms; consider a sale to a domestic or foreign strategic Buyer; or seek partial or full liquidity by attracting a private equity investor.

Particularly in these uncertain times, it is important to engage professionals who can assist middle-market company owners in considering the numerous options that are available to help achieve their goals. We at Barnard/Montague Capital Advisors would welcome the opportunity to work with company owners and/or their advisors to explore debt and equity financing or M&A opportunities.

To learn more about our services, please take a look at our web site at www.BarnardMontague.com.