News/Blog - 2012

Click on Title of interest below for full article.

Barnard/Montague Provides Financial Advisory Services to SUNBURST Plant Disease Clinic, Inc.

The principals of Barnard/Montague Capital Advisors are pleased to announce the successful completion of its strategic and financial advisory services to its client, SUNBURST Plant Disease Clinic, Inc.

|

SUNBURST Plant Disease Clinic was founded in 1987 and is dedicated to developing solutions to a wide range of soil sterility, toxicity and pollution problems in agriculture and the environment. Its affiliated companies, Fusion 360 and TimCo Technology, provide product related manufacturing, sales and implementation services.

Against the backdrop of increasing industry pressure to limit the use of fumigants in agriculture, the SUNBURST family of companies has developed, commercialized and assisted with the implementation of a range of alternative products to fumigants for the purpose of remediating a broad spectrum of long-standing agronomic problems. Their |

products are based on patented processes which have been shown to dramatically increase plant hardiness, crop yields and the overall quality of the plants benefitting growers throughout the U.S. The products are also sought after by many commercial users such as golf courses and athletic stadiums to improve turf appearance and resilience.

Dr. Tom Yamashita, SUNBURST’s President and Chief Science Officer, stated: “Barnard/Montague provided excellent service, leading us through the evaluation of the range of opportunities available to us for growth and liquidity. We look forward to working with the Barnard/Montague team once we have determined the direction we want to pursue.”

Barnard/Montague Capital Advisors is a San Francisco based investment bank providing sell-side, private placement and strategic and financial advisory services to private, middle-market companies throughout the western United States. The firm’s primary focus is on companies with revenues between $25 million and $250 million in a range of industries, including a sector focus on agribusiness.

Regulatory Required Disclaimer

The testimonial may not be representative of the experience of other clients and is no guarantee of future performance or success.

April 16, 2012

Barnard/Montague Provides Financial Advisory Services to Church Brothers, LLC, and True Leaf Farms, LLC

The principals of Barnard/Montague Capital Advisors are pleased to announce the successful completion of its financial advisory services to its clients, Church Brothers, LLC, and True Leaf Farms, LLC.

|

Church Brothers is a dynamic, vertically integrated family company that provides customers with a large variety of top quality produce and services from seed to shelf. While their current company, Church Brothers, was formed in 1999, the Church family has an 80 year Salinas Valley history of produce leadership and innovation. Steve Church, CEO of Church Brothers, stated: “Barnard/Montague provided excellent service, becoming key members of our team to review and evaluate our range of businesses and opportunities.” True Leaf Farms is the processing arm of Church Brothers. Its modern plants |

provide a comprehensive array of products including Spring Mix, Spinach, Whole Leaves, Wash and Trim, “Teen Green™” snack items

and Fresh Cut processed items. True Leaf Farms partner, David Gill, stated: “Barnard/ Montague partners David Sloan and Jeanne Montague served us well through an intensive hands-on process to analyze a complicated structure of shared ownership interests in an integrated enterprise. We look forward to working with them again as we continue to explore strategic alternatives.”

Barnard/Montague Capital Advisors is a San Francisco based investment bank providing sell-side and private placement advisory services to private, middle-market companies throughout the western United States. The firm’s primary focus is on companies with revenues between $25 million and $250 million in a range of industries, including a sector focus on agribusiness.

February 3, 2012

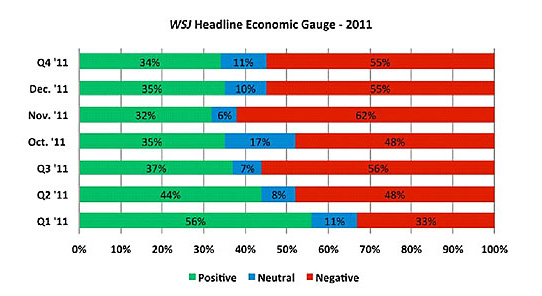

Wall Street Journal Headlines Economic Gauge - 2011 Results

We created what became our Wall Street Journal Headlines Economic Gauge in early 2009 under the premise that the count of the WSJ finance-related article headlines categorized with a positive, neutral, or negative tone could provide an

We had hoped to demonstrate the steady, albeit bumpy, improvement in the economy. Our Headlines Gauge has indeed reported that there have been many ups and downs; however, two years and nine months later the Gauge shows that there are still more negative indicators than positive, with few signs of optimism that there will be meaningful improvement in the near term - or even in the next several years. Here are the results for 2011:

The Gauge reflects what we are seeing play out: The new normal, at least for the foreseeable future, reflects uncertainty, high unemployment, difficulty accessing bank debt, continued glut of foreclosed or underwater residential real estate, an increasing divide between the haves and the have-nots, weakness throughout Europe, continued turmoil in the Middle East and North Africa, etc...

Many privately held, middle-market company owners have been waiting for the economy to improve to buoy their businesses. They are now realizing, however, that the turnaround may not come for at least several more years and that they need to adjust to this new normal. Growing revenue and improving margins are as challenging as ever, and new approaches to growth should be considered. A financial partner who can provide growth capital as well as other resources might be worth considering.

Many companies are struggling and, as a result, few are considering selling. Because of this, investors are paying premiums for those companies that are doing reasonably well and have the demonstrated ability to grow. Private-equity firms and strategic buyers are flush with capital - the private-equity industry as a whole reportedly has in excess of $500 billion of un-invested but committed capital, and domestic non-financial companies have an amount approaching $2 trillion of cash on their balance sheets. Growth through acquisition is an important part of their strategy. Such being the case, there are opportunities for liquidity for business owners whose companies are doing well.

With our deep knowledge of the private-capital markets and our years of experience working with the owners of middle-market companies, the partners of Barnard/Montague are ideally suited to assist in exploring strategic alternatives to achieve liquidity or financing for growth.

_____________________________________

Barnard/Montague Capital Advisors is a San Francisco-based investment bank providing sell-side and private-placement advisory services to privately held, middle-market companies throughout the western United States. The firm's primary focus is on companies with revenues between $20 million and $250 million in a diverse range of industries.

Please contact us if we can be of assistance:

Bailey S. "Biff" Barnard, Sr.

925-386-6171

bbarnard@barnardmontague.com

Jeanne Montague

415-928-2183

jmontague@barnardmontague.com

David B. Sloan

415-992-5463

dsloan@barnardmontague.com

242 California Street

San Francisco, CA 94111

www.BarnardMontague.com